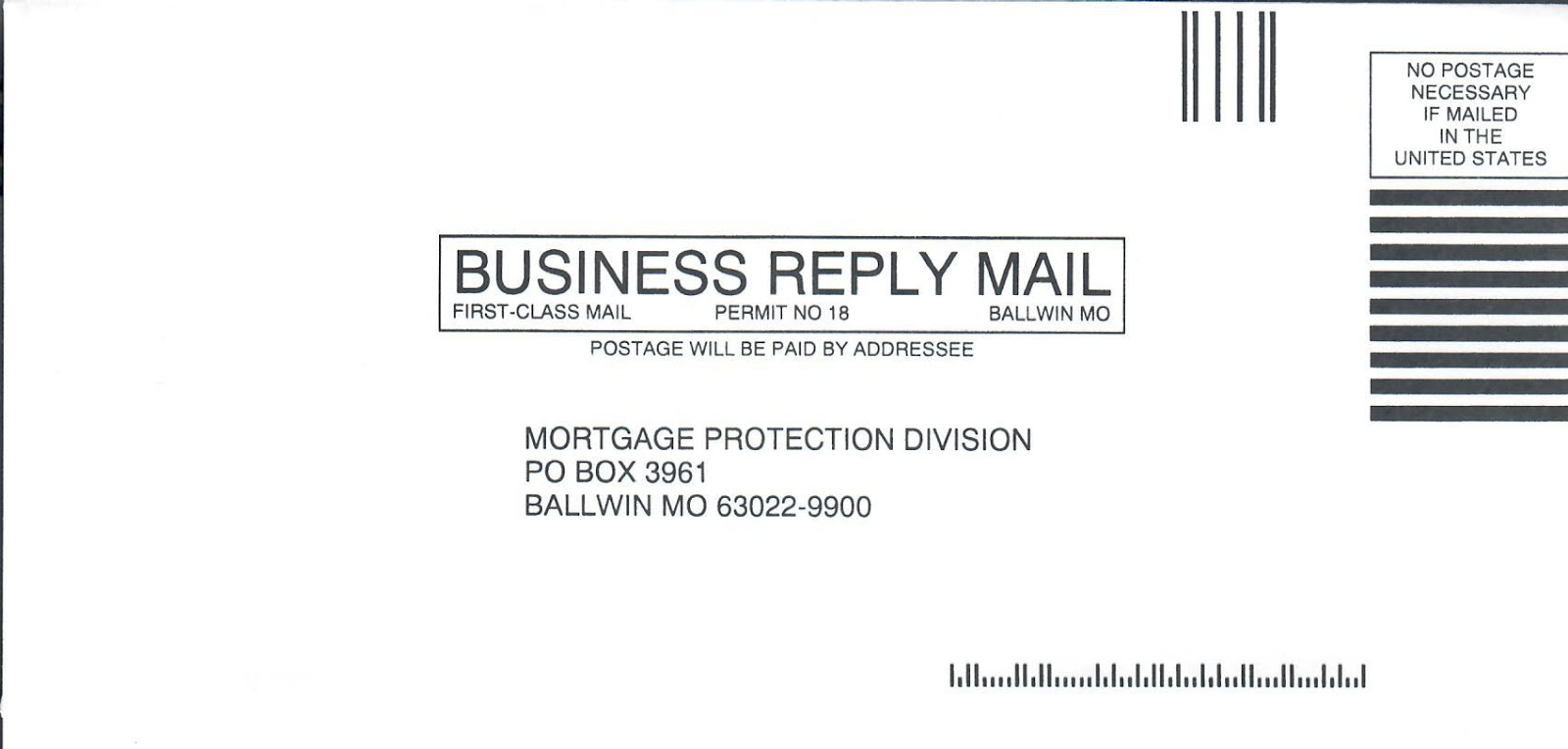

Scammers might use public information to reach potential victims, such as the sample postcard below. Scammers might be looking to steal the money you have. However, they are also seeking your data to be able to commit identity theft, so more than your money is at risk.

Most companies offering medically-underwritten level life insurance offer three or four non-tobacco underwriting classifications, ranging from Standard to Preferred Best. If you're in good health, the cost of Preferred Best Non-tobacco is likely to be significantly lower than the Standard Non-tobacco. If you're not a smoker or overweight and are taking medication to treat Hypertension (for instance), then you may qualify to be eligible for Standard Non-tobacco rates.